“Tax enforcement for thee—but not for me!” That’s Democrats’ mantra for their multi-trillion-dollar spending blowout, as they continue to promote provisions that will enable Internal Revenue Service agents to monitor the banking details of millions of Americans.

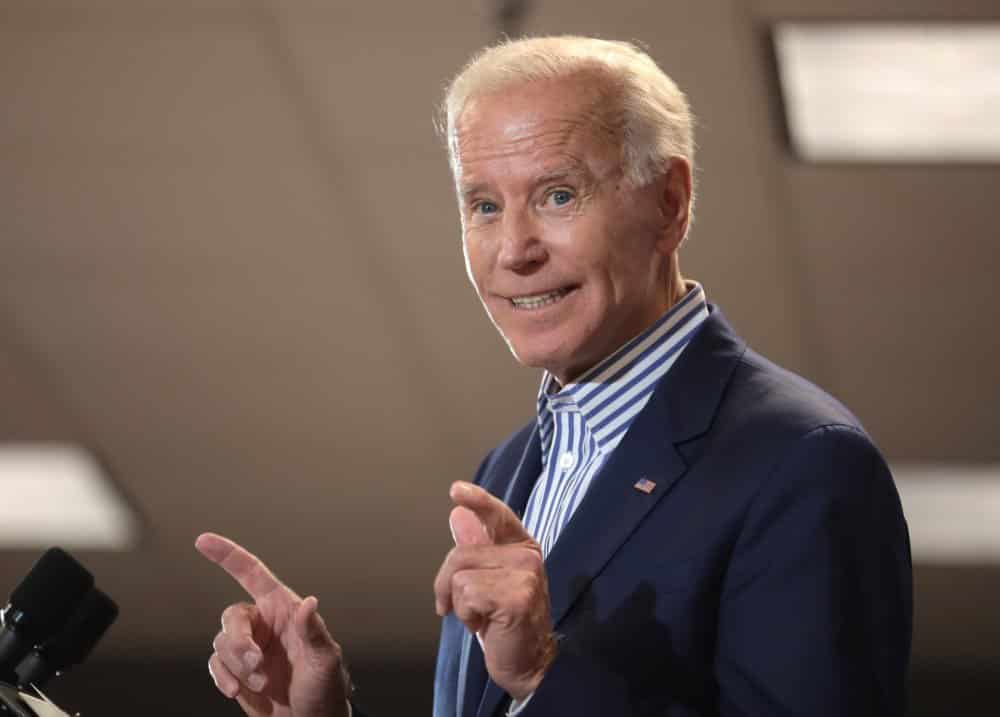

Meanwhile, Democrats say absolutely nothing about President Joe Biden, who when not telling others to “pay their fair share” dodged more than $500,000 in payroll taxes. If Treasury Secretary Janet Yellen and congressional Democrats want to make a statement about tax enforcement, they have a more obvious target right down Pennsylvania Avenue.

Tax Reporting Requirement Modified…

The issue involves a provision, included in Section 138402 of House Democrats’ draft reconciliation legislation, that would force banks to disclose account information to the IRS, purportedly to improve tax compliance.

Treasury recently announced it agreed with congressional Democrats to modify the provisions, in light of public outrage over the issue. While the original proposal would have required banks to report information on any bank account with $600 in deposits and withdrawals, the revised proposal would set that threshold at $10,000.

Treasury also claimed that “the new, tailored proposal carves out wage and salary earners and federal program beneficiaries, such that only those accruing other forms of income in opaque ways are a part of the reporting regime.” It also included various arguments to rebut “misinformation” about the new requirements, claiming that “any additional reporting will be minor” and that “only total money into accounts and total money out of accounts will be reported to the IRS.”

But Will Still Ensnare Millions of Americans

Even increasing the reporting threshold from $600 to $10,000, and exempting wage and salary income, mean millions of Americans’ bank details will get ensnared by this IRS dragnet. Think about how many Americans could answer these questions in the affirmative:

- Do you spend more than $833 per month (that’s one-twelfth of $10,000 per year) out of your checking account on groceries, dining out, gas, clothes, vacations, utilities, and any other monthly spending?

- Do you have a mortgage, or pay monthly rent—and if so, does that monthly payment exceed $833?

If you answered “yes”—and most Americans would—then your bank account would be subject to the IRS reporting requirements.

Treasury implies that, while the new requirements are “minor,” disclosing information about bank accounts will yield massive amounts of new tax revenue: “All told, a robust attack on the tax gap will generate $700 billion of additional tax collection in the next ten years—and roughly $1.6 trillion in the decade that follows” (emphasis added).

This Treasury claim has to hang its hat on the “all told” phrasing, because this new reporting requirement, while ensnaring millions in its dragnet, will yield precious little in the way of new revenue. The Joint Committee on Taxation estimated that Section 138402 would raise a measly $4 million—yes, million—in revenue. And the $4 million figure came from an estimate of the original proposal, one that set the reporting threshold at $600, rather than $10,000. The modified provision would obviously generate even less revenue.

Why Not Audit Biden Instead?

If Democrats want to support tax enforcement and raise merely a few million dollars of revenue, they can do so very easily without burdening millions of Americans, and financial institutions, with this new reporting requirement. Instead of going on a fishing expedition into ordinary Americans’ bank accounts, they can use a simpler solution: Audit President Biden’s tax returns.

I previously noted that in the years 2017 through 2019—returns that are not subject to an automatic audit, as they were filed before he took office as president—Joe Biden and his wife Jill used two S-corporations to avoid more than $513,000 in Medicare and Obamacare taxes. Both the liberal Tax Policy Center and the non-partisan Congressional Research Service have raised questions about the legality of the tax-dodging tactics the Bidens used.

When coupled with potential penalties and interest, a finding that the Bidens underpaid their payroll taxes could yield nearly as much revenue as the bank reporting provision—without adding additional burdens to banks, or threatening Americans’ private financial information. It all comes down to one question: Will Joe Biden finally pay his fair share?