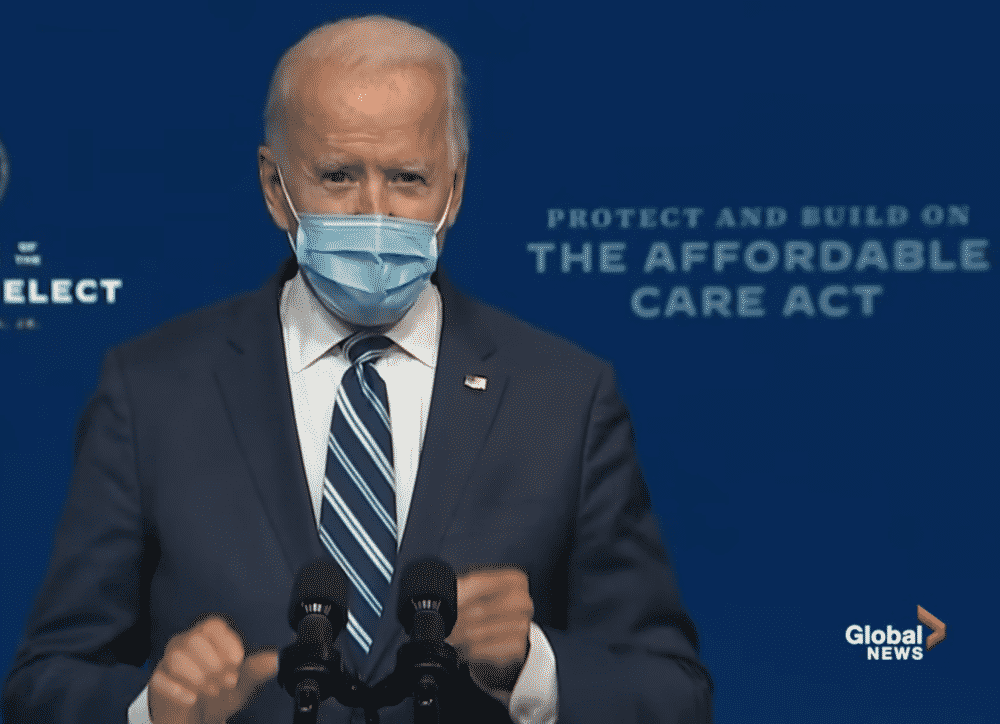

The budget President Biden recently submitted to Congress resembles President Obama’s fiscal blueprints in many respects. It taxes too much, spends too much, and with $14.5 trillion in new federal debt, it certainly borrows too much.

But Biden’s budget reflects his Democrat predecessor in another aspect: It uses hundreds of billions of dollars from Medicare to pay for (among many other things) an expansion of Obamacare.

Spending the Same Money Twice

Among its myriad tax increases, the Biden budget includes a line item to “rationalize net investment income and Self-Employment Contributions Act taxes,” applying the 3.8 percent payroll tax to all income received by “high-income” taxpayers. The Treasury’s budget explanation justifies this proposed change by claiming the “different treatment” of income by the self-employed and owners of business partnerships “is unfair, inefficient … and provides tax planning opportunities for business owners, particularly those with high incomes, to avoid paying their fair share of taxes.”

The Treasury claims the revenue from this tax increase — an estimated $236.5 billion over ten years — “would be directed into the [Medicare] Hospital Insurance Trust Fund.” That wording suggests the tax increase would improve Medicare’s solvency.

But Biden’s “families” plan proposed using some of that same money to pay for his new entitlement expansions, including an expansion of Obamacare subsidies estimated to cost $163 billion over ten years. That would siphon more than two-thirds of the revenue that’s supposed to be going toward Medicare.

We’ve seen this gimmick before. Obamacare raided Medicare, to the tune of $716 billion over a decade, to pay for that law’s new entitlements. Kathleen Sebelius, then the Secretary of Health and Human Services, infamously testified before Congress that this $716 billion could “both” save Medicare while funding Obamacare.

Only Washington politicians could claim with a straight face to spend the same money twice. President Biden, who has spent the last half-century in Washington, wants to do just that. His budget takes a page out of the Obama playbook, raising Medicare taxes while raiding those additional funds from Medicare to pay for his Obamacare expansion.

Biden: Taxes for Thee, But Not for Me

The ironies don’t end there. The very provision Biden’s Treasury Department called “unfair” because they might allow people to “avoid paying their fair share” is one the Bidens used to avoid more than $500,000 worth of taxes in the last four years. Yes, the Biden administration knows all about “opportunities for business owners, particularly those with high incomes, to avoid paying their fair share of taxes” — because the Bidens took advantage of such loopholes.

When Joe Biden left the vice presidency in 2017, he and his wife Jill established two corporations and funneled most of their book and speech income through them. By classifying more than $13.6 million of their $14.9 million income as corporate profits rather than taxable wages, they avoided paying more than $516,000 in payroll taxes on that income over four years.

What did the Bidens prioritize more than the payroll taxes that fund Medicare and Obamacare? In a word, themselves. In 2017 the couple spent $2.7 million on a beach house in Delaware. That same year, they rented a mansion outside Washington featuring nearly 12,000 square feet of space — more than the vice president’s residence in Washington — complete with a sauna, gym room, and parking for 20-plus cars.

Joe Biden has said, “Show me your budget and I will tell you what you value.” Well, he and his wife dodged hundreds of thousands of dollars in Medicare taxes, the better to fund their luxury lifestyle.

Now, as president, Biden wants others to pay the Medicare taxes he avoided — not because he views Medicare as a sacred promise to seniors, but to create a slush fund he can raid to pay for other programs. In both his family’s budget and his administration’s fiscal policies, Joe Biden shows he neither value Medicare nor the seniors who rely on it.