After the Chinese government banned cryptocurrency mining in last month, hundreds of fellow miners gathered in a luxury hotel in Western China to discuss their next steps; specifically – where to find abundant, reliable, and cheap electricity to power their sprawling operations, according to Bloomberg.

The miners sat in rows of white chairs in a hall at the Gran Melia Chengdu Hotel and listened intently to the executives at Bitmain Technologies Ltd., the world’s largest mining-equipment maker. In between presentations about Texas energy fundamentals and crypto mining in Kazakhstan, the attendees nibbled cupcakes, drank cocktails and discussed the dismal outlook for their local industry.

Many of the miners at the meeting had massive operations set up in rural areas of the country – such as the Hengduan mountains of Sichuan province, where giant warehouses packed full of mining equipment were powered by cheap electricity, often supplied via hydropower from nearby dams or from thermal plants associated with the country’s ubiquitous coal-powered plants. According to Tyler Page, CEO of Cipher Mining Technologies, electricity makes up around 80% of a miner’s operating cost.

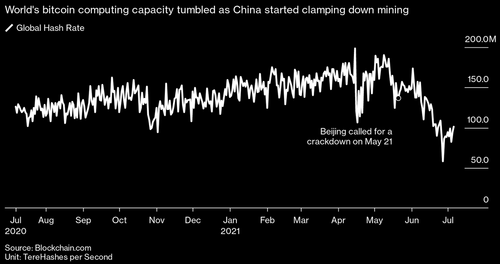

And now, Chinese mining operations have run ‘dry’ – dragging the already-plummeting global Bitcoin hashrate to new lows.

As The Economist notes: “across Sichuan, the fans have stopped whirring. In May, a government committee tasked with promoting financial stability vowed to put a stop to bitcoin mining. Within weeks the authorities in four main mining regions—Inner Mongolia, Sichuan, Xinjiang and Yunnan—ordered the closure of local projects. Residents of Inner Mongolia were urged to call a hotline to report anyone flouting the ban. In parts of Sichuan, miners were ordered to clear out computers and demolish buildings housing them overnight. Power suppliers pulled the plug on most of them.”

Where to go?

At the gathering of miners – put on by Bitmain Technologies, the world’s largest mining-equipment manufacturer, employees offered to serve as matchmakers – “hooking miners up with data centers in the U.S., Central Asia, and Europe, according to the report. They also cautioned that a headlong rush into new markets would undoubtedly lead to higher costs for all of them.

“Hold Together for Warmth, Say No to Vicious Competition,” read one slide at the event.

Just hours after the conference, the urgency of the situation came into full view. Alex, a Chinese miner who didn’t want his last name published for fear of government retribution, was out singing karaoke with some of his fellow miners when he called to check in on his machines in the mountains outside Chengdu. His colleague told him that local authorities had just shut off the power to his facility, leaving the mine silent and potentially worthless.

“All my money is gone,”: he said, cursing as he chugged a beer. “Every day I’m losing money by not running those machines.” -Bloomberg

One top destination for miners has been nearby Kazakhstan – which has over 22 gigawatts of electric power capacity, primarily derived from coal and gas-fired plants. It’s also right over the border from the Xinjiang region – which once accounted for more than one-third of the world’s bitcoin mining. Electricity costs roughly 3 cents per kilowatt-hour in the former Soviet nation, according to Dmitriy Ivanov, sales director at Almaty-based Enegix LLC. The country is also sufficiently cold enough that the data centers don’t require supplemental air conditioners to keep them from overheating – which can add as much as 30% to a miner’s power needs.

Approximately 10,000 mining machines – a combination of Bitmain’s S19Pro and Whatsminer M21S models from China’s MicroBT, are being sent to Kazakhstan via plane from Enegix’s clients. While transporting them via land would be cheaper, trucks can get held up for weeks at the border, making the extra expense for air freight worth the time savings.

“So many Chinese are reaching out to us and asking for help to relocate the equipment,” said hosting company CEO Didar Bekbauov. “They ask every Kazakh they know to help them with electricity.”

Power in Kazakhstan is already booked up, however, as the country’s electric grid is near capacity – only having added 3 gigawatts in the last 20 years, leaving little room for miners to connect. Bekbauov says he’s had to turn customers away.

“Every spare kilowatt is already booked,” he said.

Going green?

According to the report, some of the booted Chinese miners are using the opportunity to explore cleaner energy, despite the fact that the vast majority of the world’s electricity comes from burning fossil fuels – leading Tesla’s Elon Musk to suspend payments in bitcoin until the industry can clean up its carbon footprint (while Teslas themselves remain largely coal powered, of course).

While a reported 76% of miners already use renewable energy, 39% of overall energy used for crypto mining is renewable.

Spoke with North American Bitcoin miners. They committed to publish current & planned renewable usage & to ask miners WW to do so. Potentially promising.

— Elon Musk (@elonmusk) May 24, 2021

Crypto miners are coming up against a much bigger drive to decarbonize power to combat climate change. The percentage of energy from renewable sources would need to increase to about two thirds of supply by 2050, up from around 12% in 2020, to keep temperatures from rising more than 1.5 degrees Celsius from pre-industrial levels, according to the International Energy Agency. Countries around the world, including China, the U.S. and the EU will have to ramp up construction of wind farms and solar parks to come close to hitting their targets.

Renewable energy sources like wind and sunshine may be abundant at times, but demand for them is set to surge as cars, home heating and heavy industries increasingly shift to electricity. The Nordic region, which has long been a popular Bitcoin mining spot because of its ample hydropower, began running out of excess electricity earlier this year as industrial users ramped up production. “There’s a more noble use of renewable power than Bitcoin mining,” said Peter Wall, chief executive officer of London-listed mining company Argo Blockchain Plc. “But the fact is people are going to mine Bitcoin full stop. It’s not going away.”

Miners also want confidence they won’t wake up one morning to news that their business has been outlawed again. Bit Digital Inc., a Nasdaq-listed mining company, began moving some of the 30,000 machines it operated in China to North America back in October. By the time Beijing cracked down, Bit Digital was able to keep mining with as little disruption as possible. -Bloomberg

Meanwhile, some miners looking to set up shop in the United States are having to navigate regulatory differences between grids. For example, Cipher Mining Technologies – the US arm of Netherlands-based Bitfury Holding BV, is working to expand in Texas due to it being the only state with a deregulated power grid, as well as Ohio -0 due to the state’s cheap power prices and low-carbon power sources.

New York, on the other hand – where lawmakers had previously proposed harsh limitations on mining, is far less attractive.

Other locations for miners include: Kearny, Nebraska and El Salvador – which announced last month that it would be the first country in the world to adopt Bitcoin as legal tender, while the state-run geothermal electric company has been ordered to come up with a plan for volcano-powered Bitcoin mining. Late last month, one Chinese logistics firm has been airlifting mining equipment to Baltimore, Maryland.

“Every conversation we have starts with the the site’s potential power source,” according to BitOoda’s Chief Strategy Officer, Sam Doctor. “They’re looking for renewables. That’s a really important step in the greening of Bitcoin.”