Goldman Now Thinks Virus Aid Will Pass This Week, But Will Be Last

“Substantial” Package Unless Dems Win Georgia Tyler Durden Tue, 12/15/2020 – 15:30

Having flip-flopped once already, back in

September capitulating on expectations for a fiscal stimulus

this year (which earlier this year was the basis for the bank’s

bullish outlook), Goldman has just flip-flopped again in its views

on a covid stimulus deal, and moments ago Goldman’s chief political

economist Alec Phillips just sent out a note in which he said that

“over the next day or so, Congress is likely to decide whether to

pass fiscal relief measures or to push consideration of most of

them to next year” adding that “the odds of a fiscal deal before

year’s end have been improving” and “at this point, we

think it is slightly more likely than not that Congress will pass

this week a package similar to the recent $748bn bipartisan

proposal, which would be close to our standing assumption of a

$700bn (3.3% of GDP) package.” Translation: a deal will

pass in the next 48 hours.

And while it appears increasingly likely that a small package

will pass this week, Goldman concludes that “this is likely

to be the last substantial COVID-relief package unless Democrats

win both Senate seats in the January 5 runoff elections in

Georgia.”

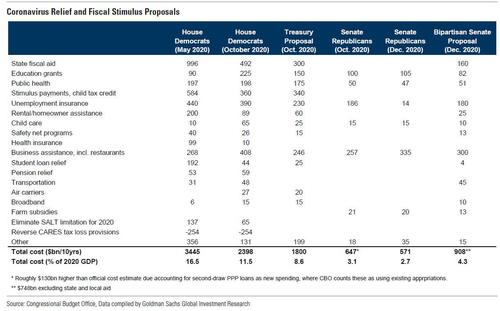

Here are the main points from the Goldman note:

1. Some COVID-relief provisions are likely to pass this

week, but the broad $908bn package that a bipartisan group of

senators has released looks fairly unlikely, in our view.

Statements from congressional leaders in both parties seem

reasonably clear that they do not believe they can leave Washington

without an agreement on COVID-relief measures. However, the issues

that have hung up fiscal talks for the last few months remain

unresolved: state and local fiscal aid, which Democrats seek, and

liability protections for businesses, which Republicans want. While

there is a small chance that these issues could be resolved soon,

in our view the path to a deal at this point appears to be for

lawmakers to put both issues aside. Senate Majority Leader

McConnell (R) proposed setting these aside last week. As of Monday

(Dec. 14) evening, Speaker Pelosi (D) has continued to press for

state and local aid. However, comments from other senior Democrats,

including Senate Minority Whip Durbin and House Majority Leader

Hoyer suggest that Democrats might be willing to support a deal

without state and local aid. If congressional leaders put this

issue and liability protections aside, it looks likely that a broad

package of COVID-relief measures will pass this week.

2. The deadline to announce an agreement is tomorrow or,

at latest, Thursday. Congressional negotiators appear to

have reached agreement on legislation to fund the government for

the remainder of fiscal year 2021 (through Sept. 30, 2021).

Legislative text of that spending bill is expected to be released

today (Dec. 15). For financial markets, the details of the spending

bill are less important than the fact that it sets a deadline for

COVID-relief talks. Spending authority for the federal government

expires Dec. 18. Without another extension, the federal government

would partially shut down. In order to meet that deadline, the

House will need to pass its bill and send it to the Senate no later

than Thursday. This means that a deal on COVID-relief would need to

be added to that bill by Wednesday evening (Dec. 16) or, at latest,

Thursday morning (Dec. 17). Even on that timeline, procedural

delays could delay final passage past Dec. 18 unless all Senators

agree to put aside procedural objections. That said, if a shutdown

occurs it would be short-lived with little macroeconomic impact.

The next step in the process will be a meeting at 4pm ET today

among Democratic and Republican leaders of the House and

Senate.

3. Fiscal relief provisions look likely to ride on the

spending bill. At a minimum, it seems very likely that

Congress will extend several policies that expire around year-end,

like broadened eligibility for unemployment insurance (UI), student

loan payment deferral, and the eviction moratorium. At this

point, congressional leaders appear slightly more likely than not

to include most of the other aspects of the bipartisan $748bn

proposal (summarized below). The largest of these would be

another round of loans through the Paycheck Protection Program

(PPP) for hard-hit businesses, payments to states to cover

COVID-related education costs, and public health funds for

activities like testing and vaccine distribution. A $300/week UI

top-up payment through March also looks likely. While we think that

there is already some expectation in financial markets that

Congress will agree to a broad package this week, we note that as

of this morning the “superforecasters” put only a 35%

probability on passage of a $750bn or greater package before

year’s end.

4. Our base case for additional stimulus remains $700bn

(3.3% of GDP). At this point, the discussions appear to be

shaping up similar to our own expectations regarding the size of

the additional fiscal measures. However, while we believed that

Congress would provide around $200bn to state and local

governments, it looks likely that if Congress acts this month, it

would include only around $100bn for state and local governments,

directed to schools.

5. A deal might have limited implications for this

week’s FOMC meeting. We believe the Fed is slightly more

likely than not to extend the weighted average maturity of its

Treasury purchases, though this has been a close call. The

announcement of a fiscal agreement prior to the FOMC meeting would

reduce the odds of a WAM extension somewhat, although there is a

fair chance that a deal would not be finalized until after the FOMC

meeting has concluded.

6. If Congress acts this month, it could be the last major

installment of fiscal relief. If Congress passes fiscal legislation

this month, it will likely create a new set of expiring policies in

March or April 2021, which could pressure lawmakers to pass

additional fiscal relief. While this might create some upside risk

to our fiscal assumptions, we would expect the amount of additional

fiscal measures Congress passes next year to be modest. With

warming weather and vaccine distribution well underway by that

point, another package worth several hundred billion dollars seems

unlikely.

7. Another round of payments to individuals and aid to

state and local governments could pass in early 2021 if Democrats

win both Senate seats in Georgia. Prediction markets

currently put the odds that Democrats win both seats at around one

in three. If they win both seats, we would expect Democrats to pass

additional measures to provide state and local relief as well as

payments to individuals, along with some other fiscal priorities

that Congress is likely to omit from any fiscal legislation it

passes this month. That could add an incremental $300bn to $800bn

to the total fiscal relief we expect under a divided government

scenario.

�