In his latest, roughly 80 minute DoubleLine webcast, Jeff Gundlach filled all the usual blanks, discussing the economy, the market and the unprecedented divergence between the two, the unsustainable trends in government spending hence the title of the webcast “no end in sight” referring to the explosive growth in US public debt…

… as well as his views and outlook (even if he did not explicitly lay out his 2021 forecast). All of that was to be expected.

What however, was a shock, is what Gundlach said amid his discussion of the US political climate which nobody had expected him to say – and what no major news organization has actually reported perhaps out of fear that it may be canceled by association. Addressing the outcome of the election, Gundlach touched on a very sensitive – to the liberal media – topic, when he mentioned the BLM riots that had spread across the country for much of the summer and fall, and yet “oddly a lot of these protests disappeared one week before the election. Makes you wonder what is going on behind the surface” Gundlach said to what would have been audible gasps from the audience if the audience had microphones.

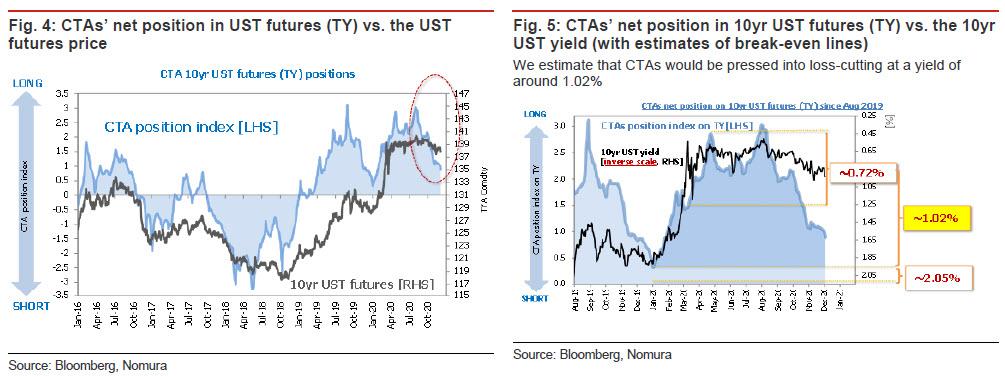

For those who missed it, the rest of the presentation also had some notable observations starting with his view on economic indicators which suggest that the 10-year Treasury yield could double to nearly 2%, who warned that the U.S. could face higher inflation over the next several years. Pointing out that since the onset of the pandemic, the yield on the 10-year Treasury bond has not exceeded 1%, although it nearly got there in late May and was at 92 basis points when Gundlach spoke. He warned that if the yield breaches the 1% “resistance level,” it could easily rise to 2%, something we first discussed last week when we pointed out that CTAs would puke once the 1.02% level is breached.

In such a scenario, the only thing that could prevent a spike in rates would be yield-curve control, whereby the Fed would purchase longer-dated bonds, according to Gundlach. Moreover fundamentals do not support today’s Treasury rates according to the bond king who noted the the performance of cyclical/defensive equites and the copper/gold ratio say the 10-year yield should be 2%. As such, he urged listeners that now would be a good time for first-time home buyers to take a mortgage, while rates are low.

Addressing inflation, Gundlach expects it to be in the 2.25% range in 2021, but said that it is a “good bet” that inflation will be higher than the mortgage rate of 2.92% over the next several years. That would happen if the Fed went to “true money printing,” which Gundlach defined as “making its debt legal tender”, something which would happen once the Fed launches a digital currency, and which would spark “hyperinflation.”

For now this is not a major concern, even though inflation expectations are elevated based on the Conference Board metrics, but are lower in Michigan consumer survey data. He pointed to the NY Fed’s Underlying Inflation Gauge which has reliably predicted inflation, and it is showing very subdued inflation pressure. The five-year break-even inflation rate has risen from a low of 0.18% in March to 1.85%, but it is still below the Fed’s traditional target of 2%. In other words, inflation is about the same at yield on 30-year bonds, meaning that its real yield is zero, and much higher than the five-year yield.

Gundlach also gave an overview of a struggling U.S. economy. He observed that COVID case counts are declining and the case patterns in the U.S. are trailing Europe by a couple of weeks. Deaths in Europe have peaked, but not yet in the U.S.

Similar to this website, he is worried about skepticism about vaccines in the U.S. and Europe, especially in France. Even if it is free, he said about a third of Americans are hesitant to take one.

Meanwhile, mobility data, which track the movement of people, has not improved since May or June; it’s why restaurant activity is down 60% year-over-year, and he fears significant small business closings now that outdoor dining has closed. Gundlach also noted that hotels are operating at about 40% of pre-COVID levels, and travel, based on TSA data, has been cut in half, noting that “LAX was empty for Thanksgiving.”

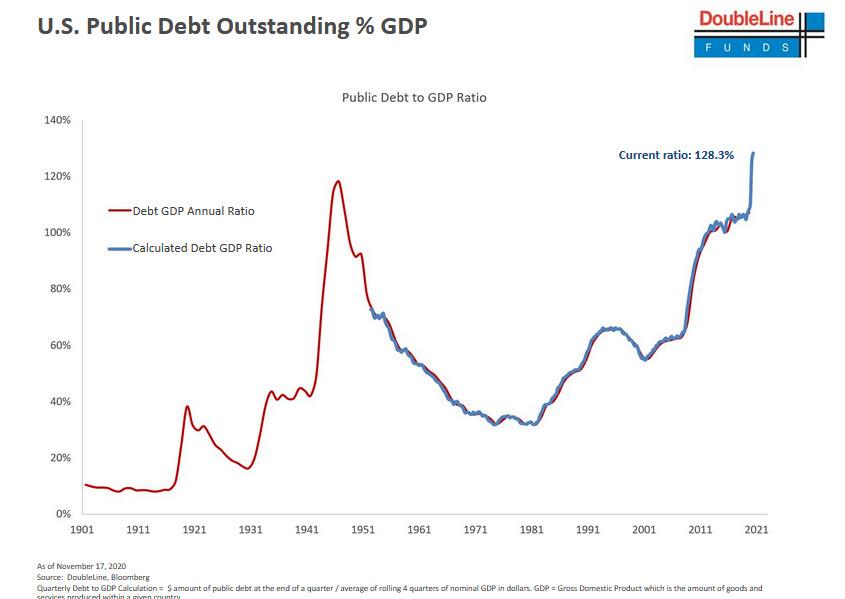

Going back to the topic of the presentation (and the top chart), Gundlach said that public debt which has been an ongoing source of concern, has risen dramatically as a percentage of GDP, and surpassed its WWII high. Mortgage debt came down this year, he said, but that was more than offset by the rising federal and state government deficits.

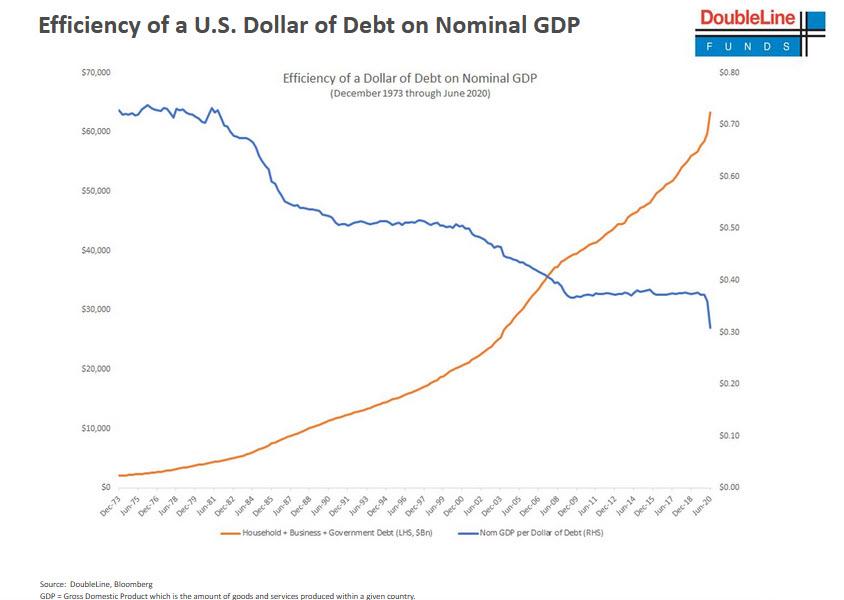

The DoubleLine founder pointed to the velocity of money supply (M2), which has been collapsing, and has been cut in half since the onset of the COVID crisis. He said that the “law of economic physics” shows that incremental debt produces less marginal GDP growth, he said.

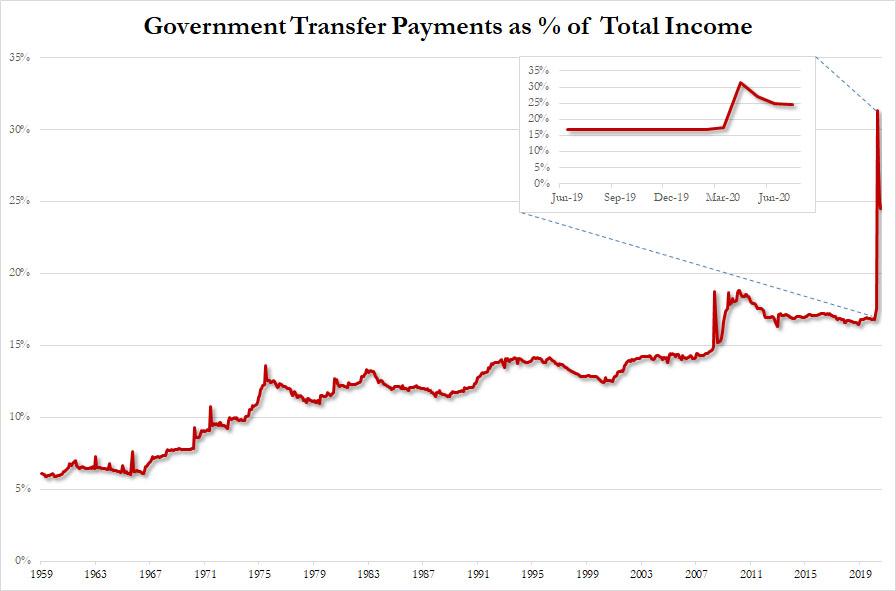

Picking up on an observation we have made on numerous occasions, Gundlach said that “the economy is living off of government support” and, referring to the title of his presentation, he asked rhetorically, “Will there be any end?” The “mindset,” he said, is to continue that support. It has led to a spike in disposable income, which has generated a divergent response across sectors of the economy; travel and entertainment have suffered, but other consumer purchases have risen.

As we pointed out many months ago first, Gundlach showed that government benefits as a percent of household income went from 10% to 24% as a result of response to the COVID crisis. It came down a bit, he said, but will go up if there is another fiscal stimulus.

“This does not lead to a healthy economy or a harmonious society,” because so many people are relying on government support Gundlach said, echoing our conclusion that the US is on its way to becoming a banana republic, if it isn’t one already.

There was some good news: consumer-loan and car-loan write offs and delinquencies are down, in part because fewer people need auto transportation. Gundlach called this a “very unusual situation,” which is as a result of government actions. Consumers still lack confidence in the economy, as measured by the Conference Board indicators, with Gundlach noting that people are worried that government programs might end. Obviously.

What all this means for the market is that as the federal debt soars, Gundlach said his greatest conviction call remains a weak dollar. That started early this year, as the dollar went from 103 to 91 on DXY index, weakening particularly against the euro and some emerging-market currencies. “The amount of debt in the U.S. is responsible for this,” as are reduced bond purchasing by foreigners and pension plans. He said he had another high conviction call early this year, which was to buy bitcoin. It is now at approximately 19,000, and has performed much better than gold.

As we noted last night, Gundlach also showed a chart on the China Credit Impulse, an indicator which he said leads industrial metals. It has been increasing this year, which presages strong performance for emerging markets.

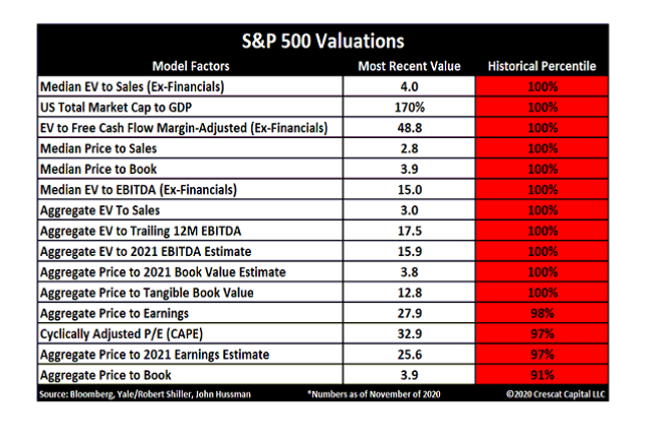

The U.S. stock market is at its all-time high based on the ratio of market capitalization to GDP. “This is clearly a non-undervalued stock market,” he said. It is at the highest valuation across a range of metrics:

Addressing the leadership in the market, i.e., the “generals”, Gundlach said that there has been a change in the performance in U.S. equities as the FAAMGs had outperformed the S&P 500 by 50% since September 2019 but that has “rolled over” and the “generals may have abandoned the army.”

He then showed an indicator based on S&P 500 earnings 24 months in the future. Even that indicator shows valuations at dot-com-lock levels; at the same time, the Russell 2000 small-cap index has performed better relative to the overall market over the last month, which Gundlach called a “powerful move.” He said he is “starting to see a reversal,” with the moves in the dollar, FANGS and small caps.

And while U.S. stock performance continues to dominate the rest of the world, particularly over the last 10 years, Gundlach said that emerging market performance will be superior to the S&P 500 going forward.

One final point: hours after Elon Musk said that he was not a Texas resident, Gundlach said that he has heard that as many as 700,000 people have moved from California as a result of the pandemic and its 12.3% income tax rate. While the bond king (who has a house in Buffalo) isn’t moving his firm from California – because other states like Florida and New Hampshire will be forced to impose higher income taxes as they develop the infrastructure to support businesses moving there – if California raises its income tax to 16.8%, which is being discussed, he said he will look more closely at moving.

His full presentation is below: