By Michael Every of Rabobank

Markets are generally trading as if we are all sailing fine seas on finer luxury yachts, basking in the sunshine and drinking gold-flecked cocktails. Guess what? We aren’t. In fact, there may potentially soon be an urgent need to find a safe harbour – if one can.

First, the US election (*again*). Sensible media say this is all over, and are focusing on Joe Biden’s socks. However, things might suddenly get stormy in the next 48 hours. Tuesday December 8 is so-called “safe harbor” day. Any state’s election outcome that is undisputed by that date is ‘locked’ into the Electoral College ahead of their actual vote on 14 December, which are sealed until read out and then approved by Congress on 6 January. (The figure who reads out those votes —and choses which electors to select, if necessary— is the Vice-President: worth remembering). Some constitutional scholars contend only 6 January matters, and some say only 20 January, presidential inauguration day. Regardless, there is a strong under-current of activity ahead of tomorrow’s “safe harbor”.

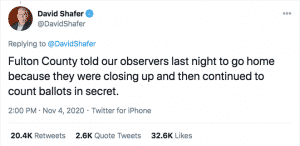

Supreme Court Justice Alito has moved forward the deadline from 4pm on Wednesday to 9am tomorrow for Pennsylvania to respond over appeals over the constitutionality of its vote-by-mail legislation. This could still mean Alito does nothing. However, having acted twice, and to within the “safe harbour”, there would appear a chance the Supreme Court acts. The question is how if so. Again, it may mean nothing; or it might invalidate some or all mail-in-votes, effectively flipping the state to Trump; or it saying that the election needs to be sent back to where the US constitution says power to appoint electors actually lies – the state legislature.

On which, there is a constitutional battle raging in at least three states: Georgia, Arizona, and Pennsylvania. State Republican leadership is refusing to call special legislative sessions to discuss the election results, yet some state legislators appear close to claiming “plenary” constitutional authority over elections to recall themselves unilaterally. All they would technically need, it appears, is a simple majority. If so, they could *potentially* flip their Electoral College votes, or send competing electors, or not send any at all. This actually has historical precedent. It is unlikely, but far from impossible in the current heated political atmosphere in the US.

Further, with key election court cases still being held in the Arizona, Wisconsin, Nevada, and Georgia state supreme courts, as well as in other courts in those states and in Michigan, it is not unthinkable –if still unlikely– that the Supreme Court opts to roll several or all of them into one ruling –**if** it acts– to try to find a clear resolution, either tomorrow or at least ahead of 14 December. In short, keep enjoying your gold-flecked cocktails – and maybe rightly so. Yet seasoned sailors know that sudden surprises do sometimes happen at sea.

Brexit presents a salient (and saline?) comparison. Since the day in 2016 when markets first choked on their gold-flecked cocktails at the UK referendum result, the assumption has consistently remained “there will be a deal”. With a timetable not much different from that in the US, the outcome is on even more on a knife’s edge. Access to fishing *may* be sorted, but the core issues of ‘level playing fields’ and ‘UK sovereignty’ certainly are not. Trade talks will continue today, and tonight PM Johnson will have to make a final call…and *potentially* then a statement to the nation that there will be no deal. (The only alternative will be to say talks continue until the EU summit on Thursday, the final deadline.)

In that case, as UK government analysis leaked yesterday makes clear, we end up with the ‘break-up of the USSR’ style border and supply-chain chaos nobody wants, and some food and medicines will be in short supply as soon as 1 January. At least we had a lot of practice during Covid-19.

These are two market-shocking events we have been flagging for some time: but there are more.

The US is pressing ahead with more sanctions against Chinese officials. This time there are suggestions that even more important figures within China may be targets. Note already-sanctioned Hong Kong CEO Carrie Lam is now reportedly paid in cash, and has to sit on literal piles of cash at home. Meanwhile, a former Hong Kong pro-democracy lawmaker currently in Denmark has seen his and his family’s Hong Kong-based bank accounts frozen under charges related to the territory’s new national security law. In short, on either side of this geopolitical argument —and for those caught unhappily in the middle– where, and what, one thinks is a true ‘safe harbor’ for one’s funds may need to be rapidly revised. (Also note the US Congress will also vote this week on legislation to help Hong Kongers wishing to leave for the States; that as applications for the path to British citizenship from Hong Kong have reportedly skyrocketed.)

Moreover, as some lick gold from the sides of their crystal glasses and ask for another round from compliant central banks, the head of the World Food Programme on Friday warned 270m people are “marching toward starvation” and that, in some countries, famine is “around the horizon” while “2021 is literally going to be catastrophic.” In short, as commodity prices soar on the back of supply shocks, demand shocks, and a market view of a Great Reflation (for those with lots and those with yachts), food prices in countries already smashed by Covid-19 are about to soar. You want a recipe for real instability? That is what it looks like.

In terms of key data seen today, China just reported its largest trade surplus in decades at over USD75bn, as all things Covid-related continue to fly out the door. Yet the only positive in the data from a global growth perspective was that imports were up 4.5% y/y, a welcome change from the contraction we have been seeing until now. Even then, consider how many of those imports were of soft commodities vs. higher value-added goods.

Meanwhile, the market continues to push key US 10-year yields higher “because gold-flecked cocktails”. Even the US payrolls report on Friday, which came in at 245K vs. 460K expected, still ended up seeing 10-year yields well up. The backdrop we describe above means we were trading around slightly better at 0.95% at time of writing, but expectations are continuing to build of a move above 1%, potentially triggering further Treasury selling. No safe haven there if so. Given the problems the trend of higher US borrowing rates will then cause for many, the market might secretly be happy for a risk-off political event to appear, like a kraken, to keep yields in check.